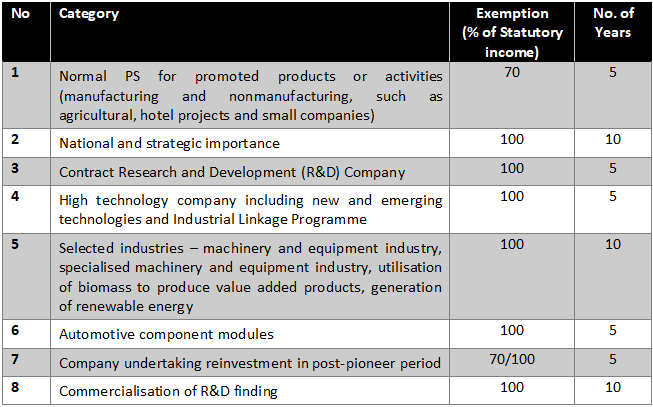

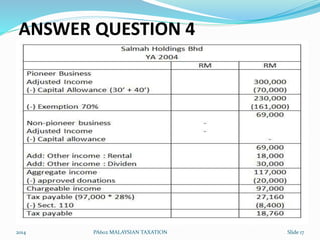

Eligibility to Claim Reinvestment Allowance 1 5. Pioneer status often provides a 70 exemption of statutory income for a period of 5.

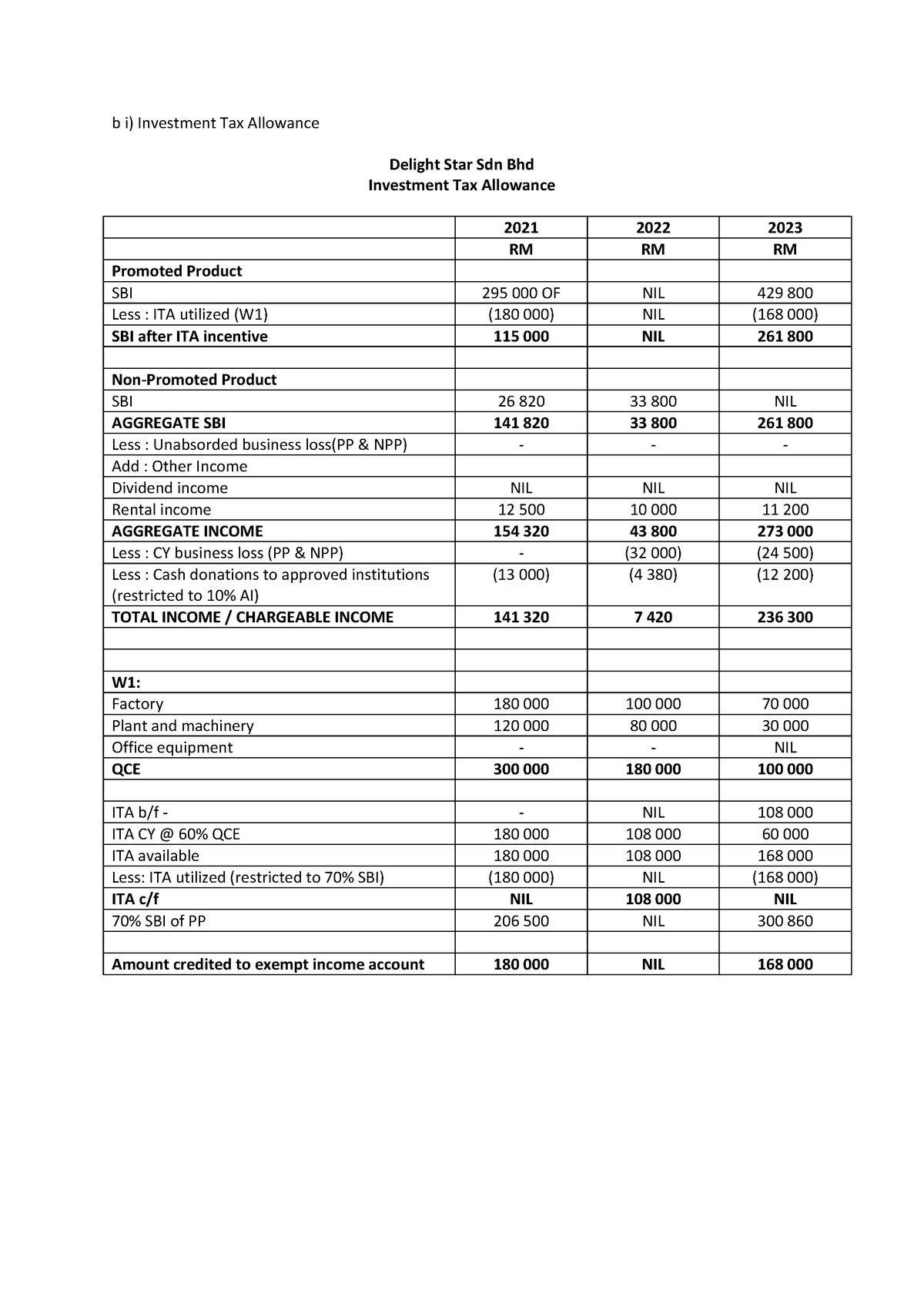

Tutorial 1 Investment Tax Allowance Ita Ra B I Investment Tax Allowance Delight Star Sdn Studocu

Malaysia has a wide variety of incentives covering the major industry sectors.

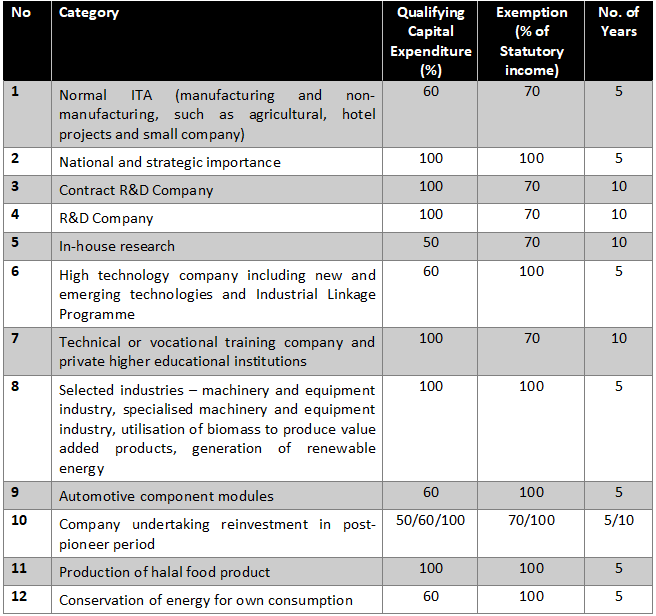

. The article is based on the. Tax incentives can be granted. Investment Tax Allowance ITA.

Latest Updates on Reinvestment Allowance. Income tax is an important factor that needs to be taken into consideration in the planning of investment in Malaysia as this will affect the. By Editorial Team 30032021 224 pm Investing in solar is a big step.

Pioneer status investment tax allowance and reinvestment allowance. Extension of Special RA. In terms of rate of incentive Green.

The income tax exemption is equivalent to 70 of the statutory income derived from providing the qualifying green services for a period of three years of assessment and the. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. Pioneer status often provides a 70 exemption of.

Last reviewed - 13 June 2022. The main tax incentives available in Malaysia include pioneer status an exemption based on statutory income and investment tax allowance based on capital expenditure. In tandem with the Malaysian Governments agenda to drive the growth of Malaysias green economy the Green Technology Tax Incentive was introduced in 2014.

Generally tax incentives are available for tax resident companies. Based on the Finance Act 2021 which was gazetted on 31 December 2021 the Special RA is extended for an. Corporate - Tax credits and incentives.

Also 100 of the. This article is relevant to candidates preparing for the Advanced Taxation ATXMYS exam. Solar investment solar leasing green technology how to take.

Qualifying Period 25 10. Solar Return of Investment in Malaysia. Minimum Period of Operation 2 6.

Nevertheless a company eligible for a certain tax incentive might only pay an average effective tax rate of 75 with only 30 of the. In Malaysia the corporate tax rate is now capped at 25. The Malaysian government extends a full tax exemption incentive of fifteen years for firms with Pioneer Status companies promoting products or activities in industries or parts of Malaysia.

Since 2018 the Malaysia Government provides Green Investment Tax Allowance as an initiative to encourage the purchasing of green technologies. Qualifying Project 8 8. Capital Expenditure 13 9.

Up to 10 years for new companies and up to 5 years for expansion projects 100 exemption is provided from the year they start generating statutory income. The objectives of the incentives are. Proactive planning to maximise tax Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia.

This is also in-line with the Malaysias commitment to reduce 45 of Green House Gas GHG emission intensity by 2030. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

What Is An Investment Holding Company And When Is It Useful

The Green Investment Tax Allowance Gita Maqo

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Chapter 5 Investment Incentives

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Tax Incentives In Malaysia The Potential Impact Of The Implementation Of G7 Global Tax Reform

Net Energy Metering Schemes Solar Sunyield

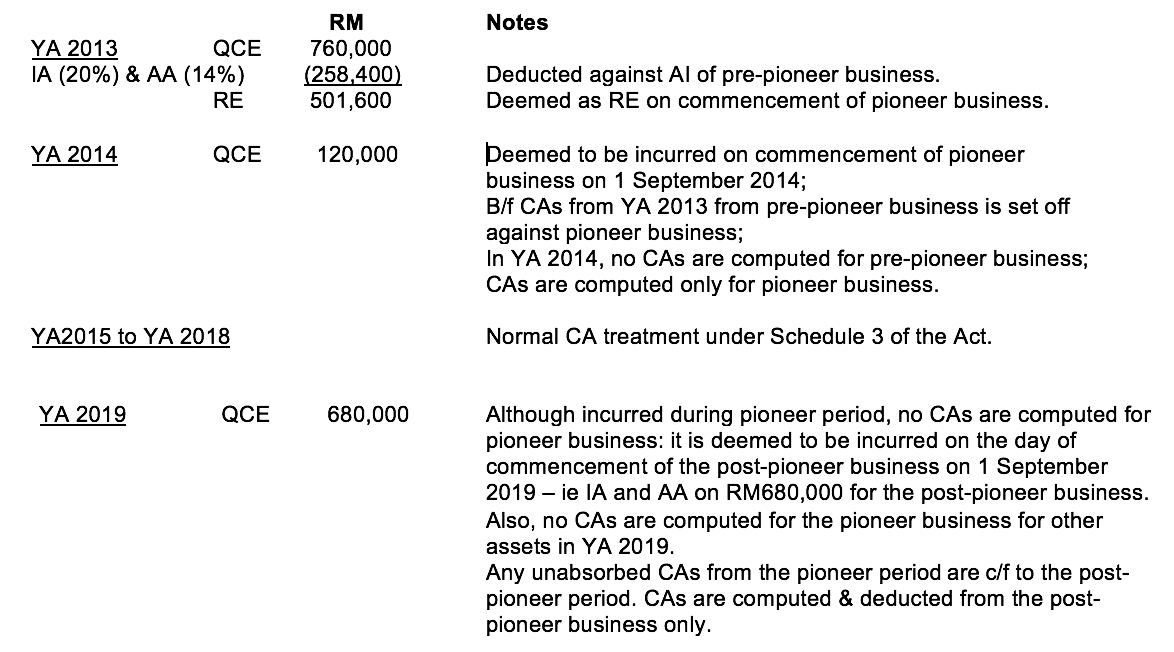

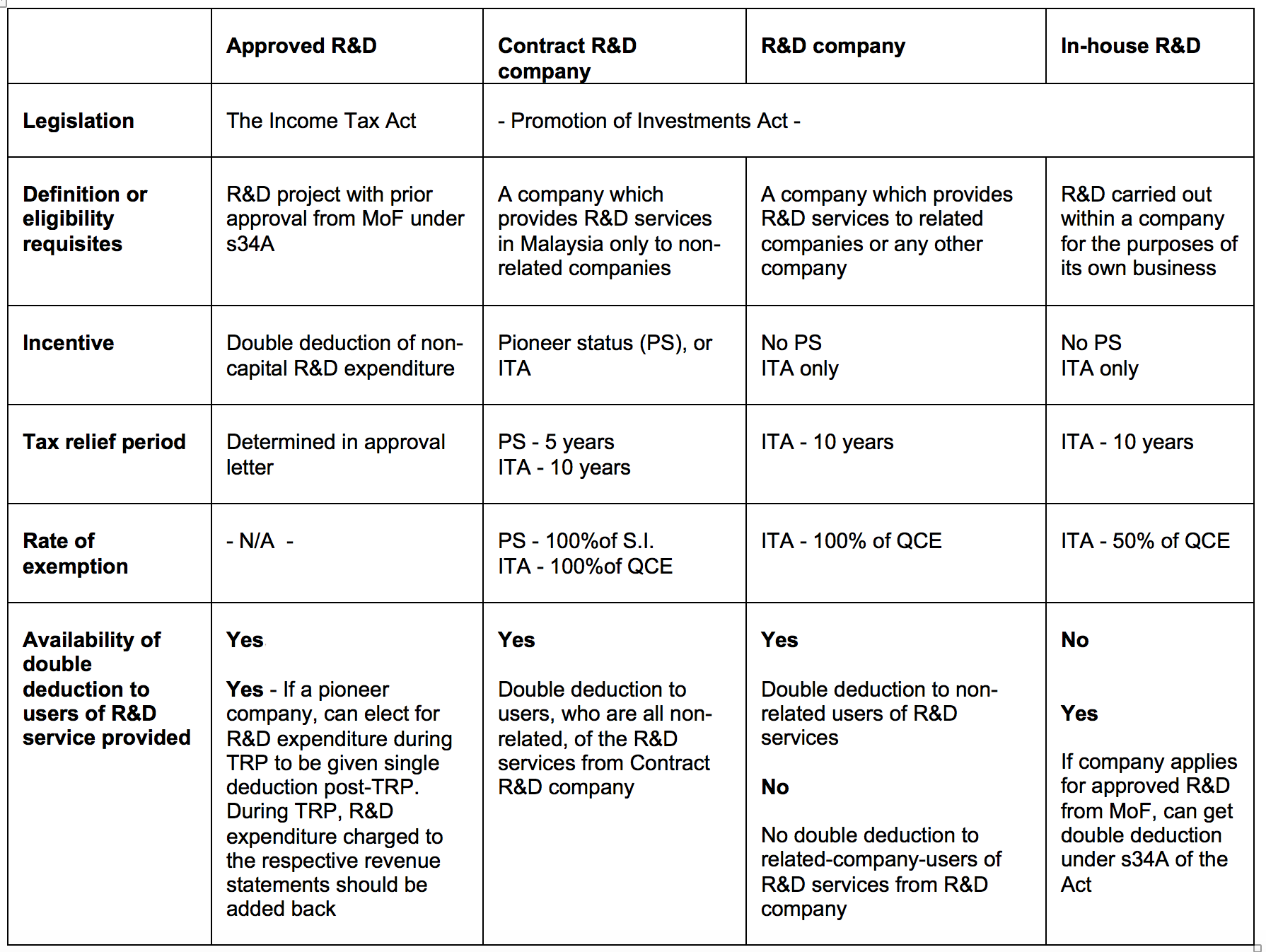

Tax Incentives For Research And Development In Malaysia Acca Global

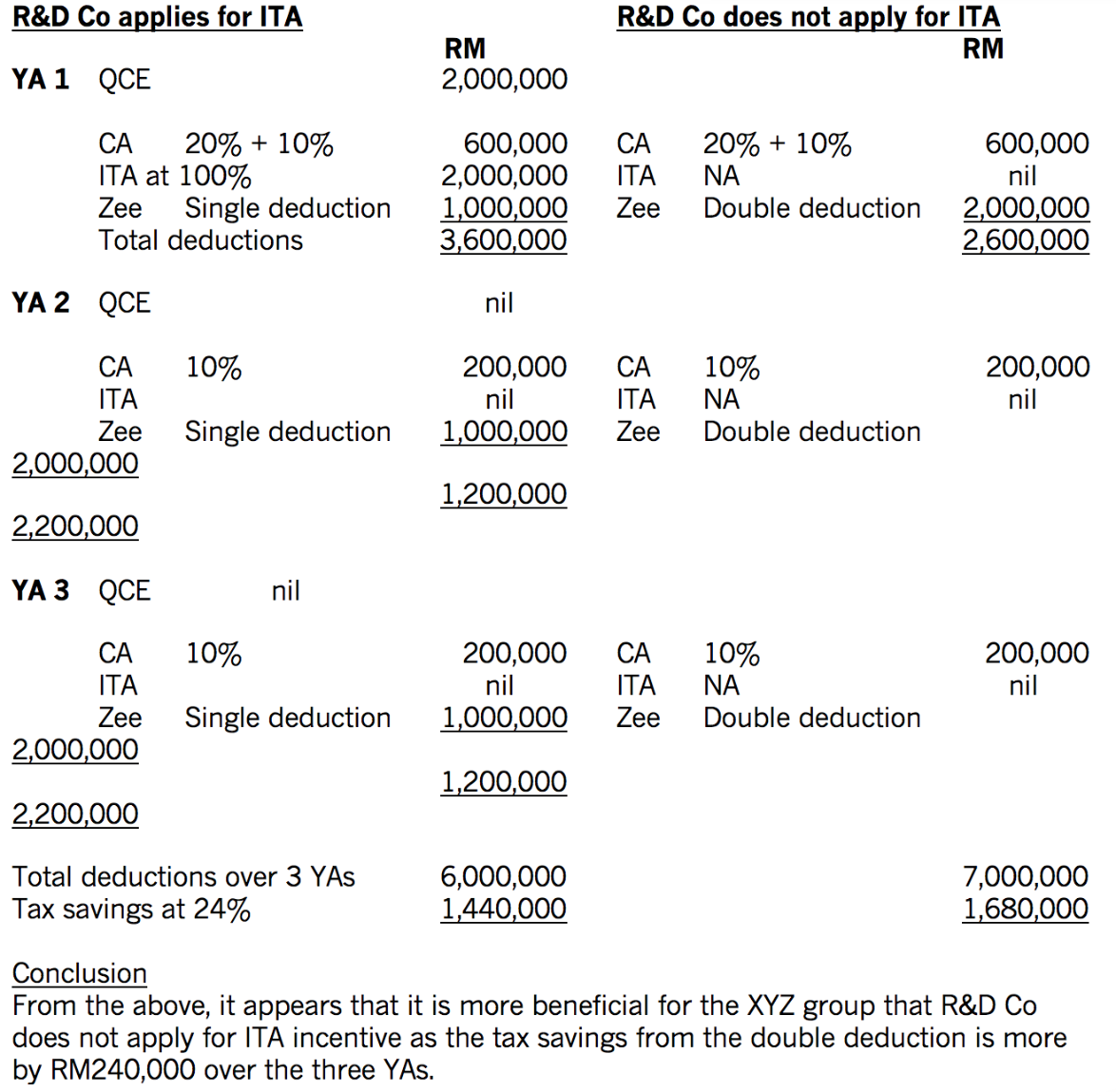

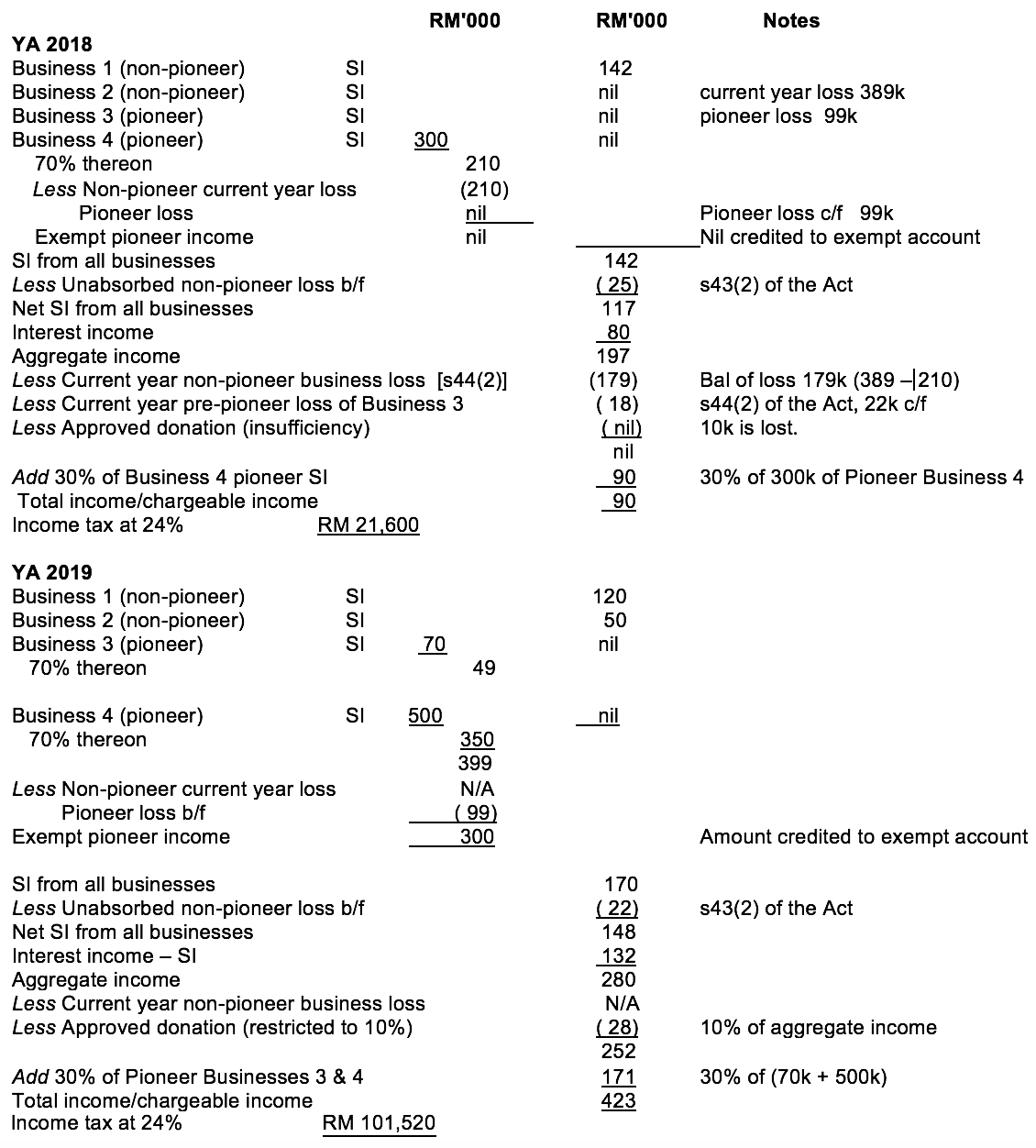

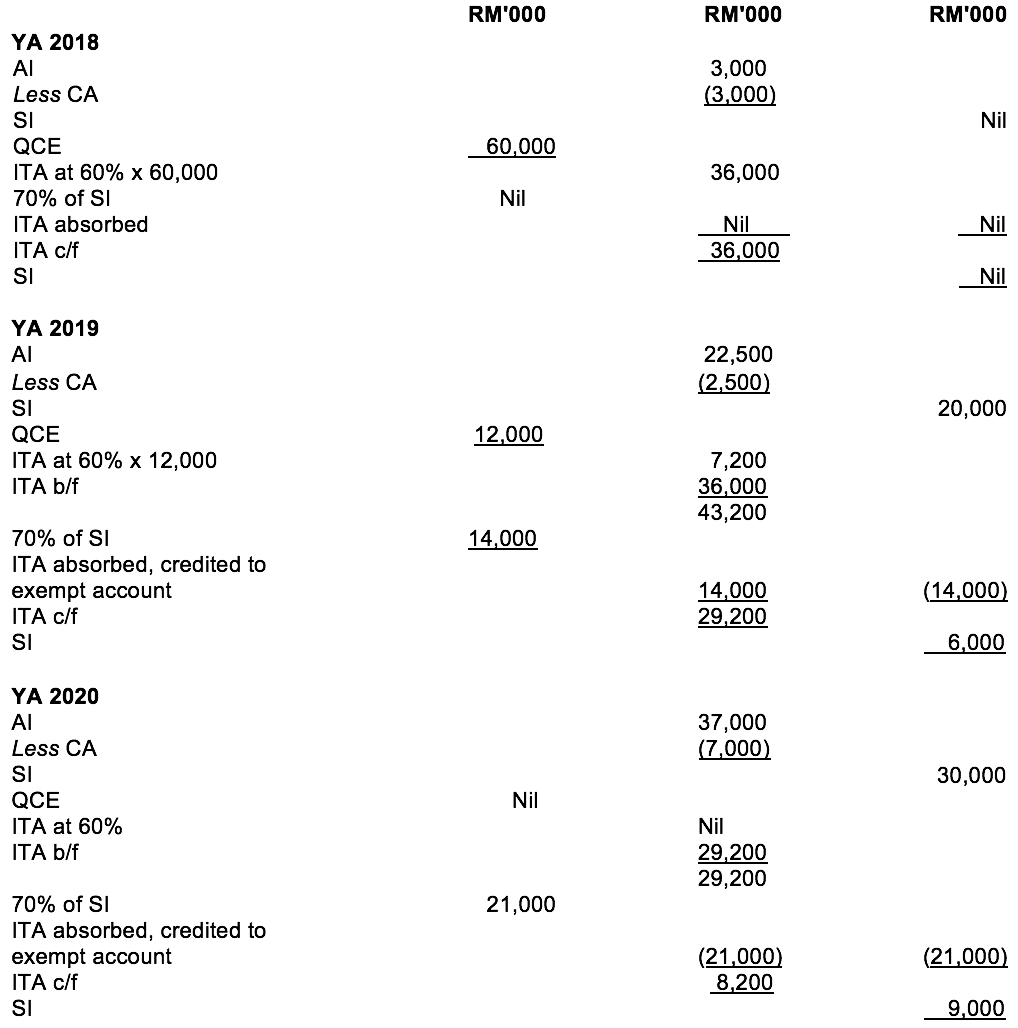

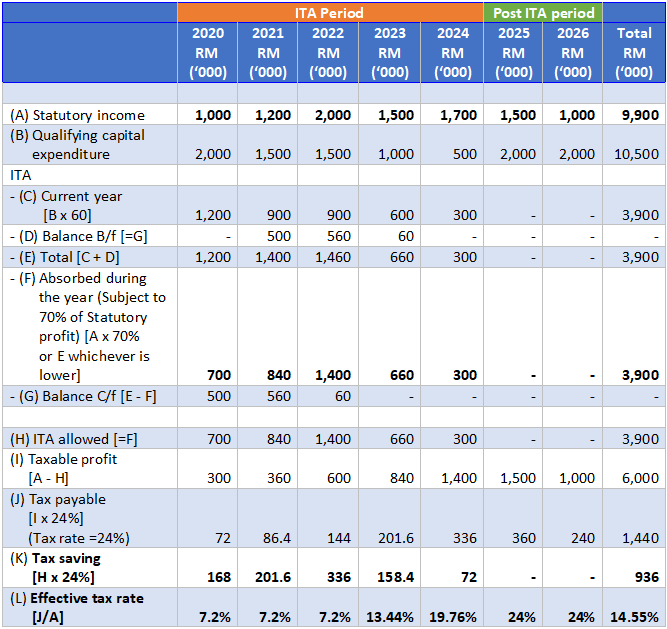

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives For Research And Development In Malaysia Acca Global

Malaysian Company Solar Tax Incentives

Malaysian Company Solar Tax Incentives

Malaysian Companies Solar Tax Incentives By Helmi Medium

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia